Although Google Pay and Apple Pay have long ceased to work, for owners of smartphones with NFC, there is one more alternative option from domestic developers – SberPay. Setting it up is no more difficult than more familiar systems.

SberPay — what is it and how does it work

The SberPay contactless payment service is included in the tools available in the SberBank Online app. This application began its existence in 2008 and has been constantly developing and improving since then. So, in 2020, the possibility of contactless payment appeared, just thanks to the SberPay function.

At its core, SberPay is a direct competitor to similar contactless payment services that are available on smartphones by Google and Apple. The service allows you to make purchases without using physical bank cards at any outlets equipped with terminals, as well as make purchases on the Internet.

How to install SberPay on your phone

It is worth remembering that the device must work on the basis of the Android operating system version 7 and higher, otherwise the application cannot be installed. Smartphones running other operating systems, such as iOS, are not suitable for installing the application.

In addition, NFC technology must be available in the smartphone, that is, the device must have a special module that allows you to transmit signals over short distances. It is this module that provides the possibility of contactless payment.

How to use SberPay on Android OS

To activate the service, first of all, you need to install the SberBankOnline application on the device that will be used for transactions. This can be done in the Google Play service. Before installation, it is important to ensure that the latest version of the application is being installed.

After installing the application, you need to log in using your bank card number. If there is no card, you will have to issue it, as this is a necessary condition.

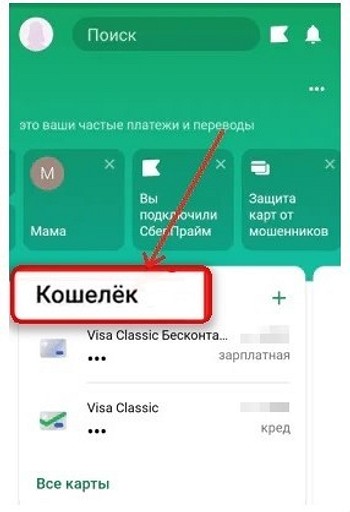

After authorization, in the main menu, select the “Wallet” section. In this section, you can choose from those cards that are available and can be used for the Sberpay service.

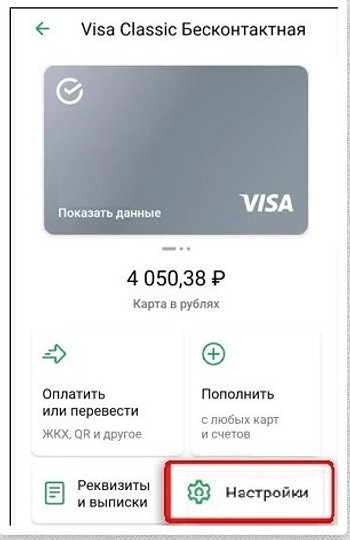

Choose a card. Which we will use. At this time, only cards of the Mir payment system are allowed to be used. Let’s go to Settings.

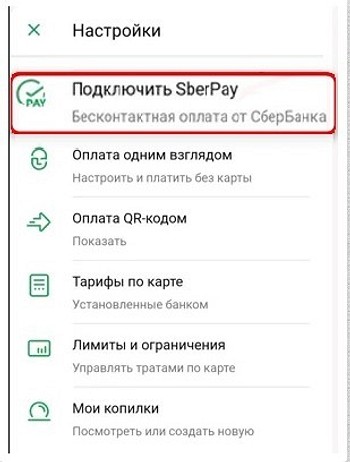

In this section, you can change the spending limits from the card, set up payment at a glance, find out the available rates set by the bank, and so on. We are interested in the “Connect SberPay” function. We choose it.

In the next window, select the “Connect” function.

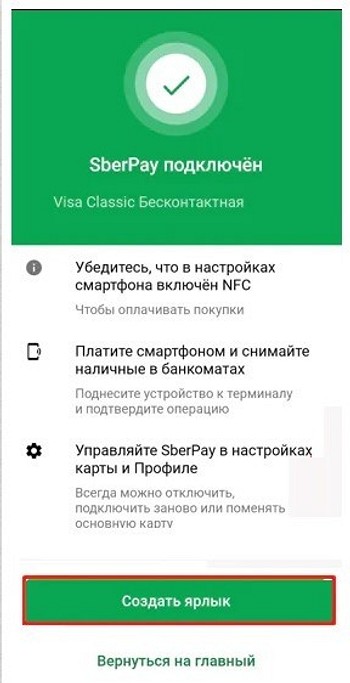

After that, a notification will appear that the service has been successfully connected.

How to create a SberPay label on the phone screen

If necessary, you can display the service shortcut on the phone screen. To do this, select the appropriate section in the window.

For the service to work correctly, you need to set up a screen lock. If it is not configured, select the appropriate menu item in the settings and activate it.

Additional settings

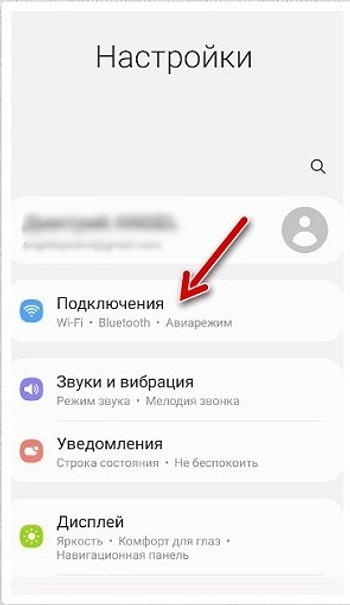

For maximum ease of use, it is recommended to make SberPay the default application. To do this, go to “Device Settings” and select the “Connections” menu item.

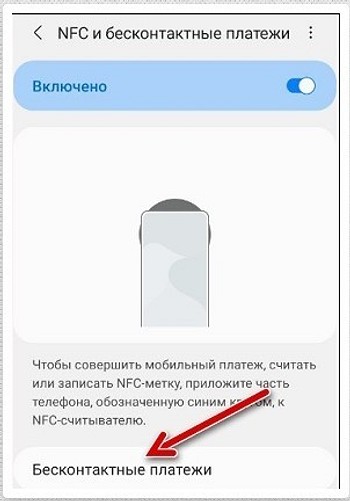

First of all, you need to activate the NFC module if it has not been done before. In the same section, you need to go to the “Contactless payments” section.

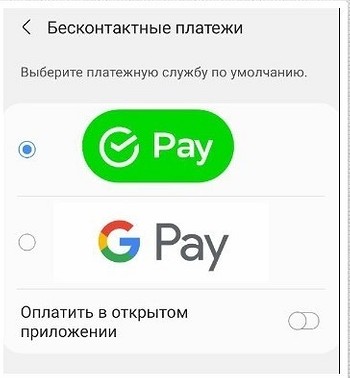

Install the SberPay service “By default”.

SberPay — how to use

An important feature of contactless payment using the Sberpay service is the double bringing of the device to the payment terminal. In Google Pay, you can pay even without unlocking the screen, while the payment cannot exceed a certain amount.

When using SberPay, this option is blocked. This is done in order to prevent fraudulent withdrawal of funds, which can be carried out by attackers simply by bringing the terminal to the smartphone, even if it is locked and lies in a purse or pocket.

There are two ways to pay with Sberpay:

- Open the application and bring the device to the terminal. After that, information about the payment will appear on the screen. Next, you will need to unlock the smartphone in the way that is set by default, be it a password or a fingerprint. After that, you need to bring the device to the terminal a second time.

- Open the SberBankOnline application and select the SberPay Payment section in advance. Unlock the device and bring it to the payment terminal.

Such payment methods may not seem convenient, however, they provide reliable protection against unauthorized debiting of funds and prevent fraudsters.

Answers to frequently asked questions about SberPay

When installing and using the service, questions may arise. Let’s consider the most common of them.

Which cards can be linked to the SberPay service

At this time, only cards issued by Sberbank and working in the Mir payment system can be linked to the service. There are no other possibilities, but the functionality is sufficient to meet all the needs of users-owners of cards of this Russian system.

SberPay writes no cards available

It is necessary to issue and connect cards that are allowed at this time. Cards that are connected to the Mir payment system are supported.

Why SberPay doesn’t work

There are several reasons why a service cannot be activated or a purchase cannot be made. Consider the main ones: • Device modifications

The most common problem in which the SberBankOnline application does not start on the device is various modifications that are installed on the smartphone. This may be a pirated smartphone firmware, a device hacked using third-party applications, and so on. It should be remembered that the firmware of the smartphone should be “clean.”

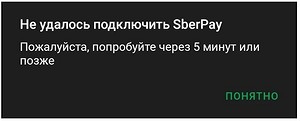

Another reason why the SberPay service cannot be activated is an overloaded system. In this case, a notification of this type will appear on the screen:

In this case, you need to wait a few minutes and try to activate the service again. If the problem is not solved in this way, then you need to uninstall the application and reinstall it. • Slow Internet

There may be problems with the connection, you need to wait or connect to a faster Internet • Old version of the program

It is also important to install the latest version of the application from official resources. This is necessary for the correct operation of the service. • Problems with the Internet or Sber servers

Payment may not go through due to the fact that there is no Internet connection or the connection speed is insufficient for the transaction.

In addition, the service itself may fail. To check if it works, you can make a free call to the support line at 900, or go to the site yourself and view the error report online.

If the contactless payment module is damaged or its software is damaged, then payment using the service is not possible.

Often, users forget to check the card balance before making a purchase, and this leads to the fact that the payment is rejected. In addition, you should re-issue cards in advance, the term of which is coming to an end.

The service not only makes it possible to pay for online purchases, but also makes them easier and safer.

Is it possible to pay for purchases in online stores using the SberPay service

• No need to enter card details. When paying, simply select the “SberPay Payment” item;

• Payment is made without transferring card data to “third-party services”, there is no risk that this information will get to scammers;

• When paying, you need to unlock the device again, which prevents payments that are not authorized by the cardholder.

It is recommended to use the SberPay service to pay for purchases on the Internet. This will protect the funds from attempts to steal them.

To connect, you need to activate Internet acquiring from Sber. Then activate the payment acceptance service. On the product page, the button “Payment by SberPay” will appear.

Is it possible to accept payment using the SberPay service

For business owners, it is possible to connect the function of accepting payments through the service. This allows you to simplify the payment process and make it safe for both the payer and the final beneficiary.

Sber systems are constantly being improved and developed. This is a whole ecosystem that all bank customers can use. The mobile applications of the leading Russian bank are simple and convenient, and the SberPay service has become the next step in raising users to a new level of comfort.

Another recent trend is VPN services. Read what free options we found among the many.

Was the article interesting?

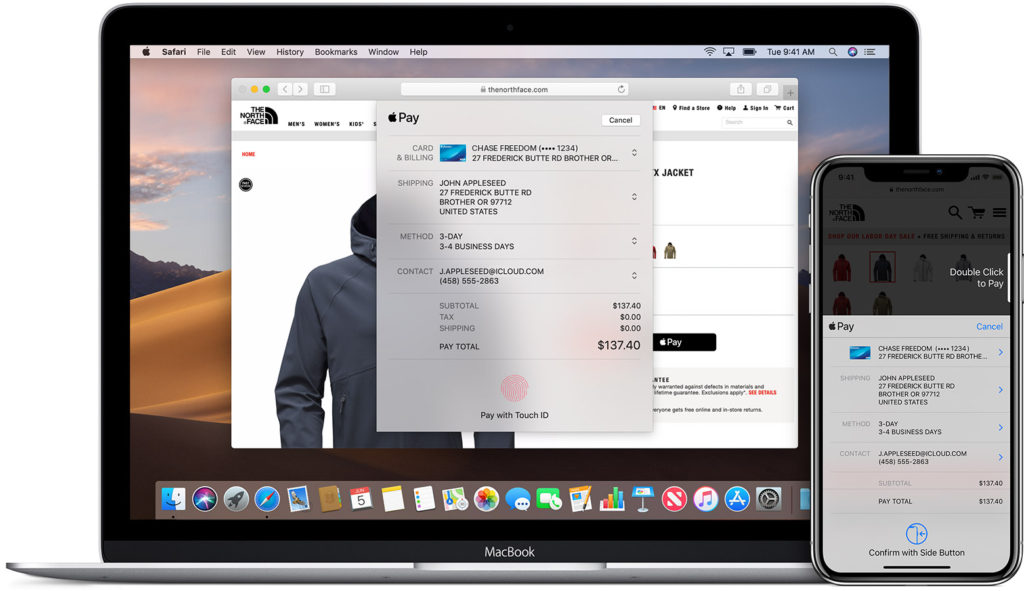

The contactless payment system is constantly evolving. With ordinary cards that need to be applied to payment terminals instead of being inserted, few people can be surprised. But this is only part of the possibilities of such a contactless service. Sberbank was the first in the Russian Federation to provide all its customers with the opportunity to link cards to the Apple Pay service and use devices running the iOS operating system (smart watches and smartphones) for all kinds of payments.

How to connect a card on iPhone?

How to pay with an iPhone instead of a card?

Advantages and disadvantages of the system

Apple Pay is a special service for making payments using Apple’s mobile technology. It features a simple control system, guaranteed safety and reliability. With it, you can both make purchases in online stores and pay at regular outlets. It is noteworthy that information about customer cards is stored only on the device. It is not sent anywhere and is not stored anywhere except for a smartphone or smart watch. The only thing you need to worry about is the safety of your devices. Apple Pay works with most modern models of Apple technology, but has its own requirements and features that you need to consider.

Requirements

Apple Pay is compatible with iPhone 6 and above and Apple Watch. The main thing is that the Face ID and Touch ID functions are available. The latter is not required in some devices. You can check whether the device supports this service or not on a special page on the Apple website or look in the list below. In addition, the following requirements must be met:

- The customer is signed in to iCloud.

- Apple Pay app installed.

- The client has MasterCard or Visa cards.

- There is a Sberbank application on the smartphone.

- The client has an online registration in the Sberbank system.

The last two points may not be fulfilled depending on which option of connecting to the service the person chooses. Also, as it is easy to see, the MIR system is not supported. This must be taken into account at the stage of issuing a means of payment. In addition, it is recommended to use cards of the Standard/Classic type or higher (Gold, Platinum, and so on).

What devices can I use with Apple Pay?

Sberbank, as a card issuer, offers its customers a wide range of payment methods that can work with this service: Mastercard Black Edition, Gold and World Elite. Visa Classic, Gold, Platinum and Mastercard Standard, Gold and

How to connect a card on iPhone?

In order to link a Sberbank card to an iPhone, there are two main ways: directly through the Sberbank smartphone program or in the Apple Wallet service. The connection procedure is slightly different, but the result in both cases will be the same.

Via Sberbank Online

To connect the Apple Pay service through the Sberbank Online mobile program, you need:

Via Wallet

The second connection method is via Wallet:

Advantages and disadvantages of the system

The system has only one drawback – if the phone is lost, if someone can get access to it (hack), he will automatically get access to all the client’s payment cards. True, for this he will still have to hack the application itself, which is very difficult. There are no other shortcomings. Benefits include:

- You don’t have to pay to use this service.

- No need to carry payment means with you. All cards can be saved to Wallet.

- Fast and easy way to pay for any goods and services.

- You can pay at any terminals that support the contactless payment function.

- No internet connection is required to make a payment. The data is stored only on the client’s smartphone and is not transmitted anywhere. When paying, the smartphone sends a signal identical to that sent from the customer’s card.

How to add a card to SberPay

We will tell you about the SberPay service from Sberbank, what it is, what features it has, how to add a card to it and whether it can be done today.

How to add a card to SberPay

How to pay with SberPay

SberPay is a contactless payment service designed for Android OS devices for Sberbank customers. With it, you can pay in stores that accept contactless payments using MIR payment system cards.

The system guarantees the complete security of the user’s money and card data.

SberPay features

- Making payment for purchases.

- Checking the card balance during the payment operation.

- When touched, the paid amount and currency appear on the smartphone screen.

- If there are not enough funds on the card, the user receives a notification.

- It is possible to adapt the application to the design of the card.

You can add a card using the functionality of the mobile application.

What you need to add a card

To add a card to the SberPay service, you will need the following:

- Be a Sberbank client, connect to Sberbank Online, install a mobile application.

- Android smartphone with NFC contactless payment technology and operating system version 7.0 or higher.

- MIR card issued by Sberbank.

Step by step instructions

How to add a credit or debit card to Sberpay:

How to pay with SberPay

- Start the service.

- Log in with your fingerprint.

- Check the operation.

- Touch the phone to the terminal.

When manually started

- Create a shortcut to launch manually.

- Confirm the operation.

- Bring the phone to the terminal.

Why the card is not linked

The problem may occur due to a lack of communication, if the card has expired or is blocked.

Important! At the moment, the bank has temporarily limited the addition of cards with SberPay. After the restrictions are lifted, the bank informs customers. You need to follow the appearance of such an opportunity on the bank’s website.

Lack of support

Linking a bank card may not work due to slow internet, communication problems. In this case, you should just wait.

Card expiration date

If the card expires, you need to reissue it in a timely manner.

Blocking

If the card is blocked, it will not be possible to link it.

What to do if problems arise

No, the service only works with Sberbank cards.

Is it possible to pay for purchases in an online store through SberPay?

Yes, you can do it by simply clicking on the SberPay button.

Conclusion

- You can connect a credit or debit card of the MIR payment system issued by Sberbank to SberPay.

- For the current day, cards are temporarily not added to SberPay.

Full year without interest

180 days without %

PJSC Bank FC Otkritie

120 days max

PJSC BANK URALSIB

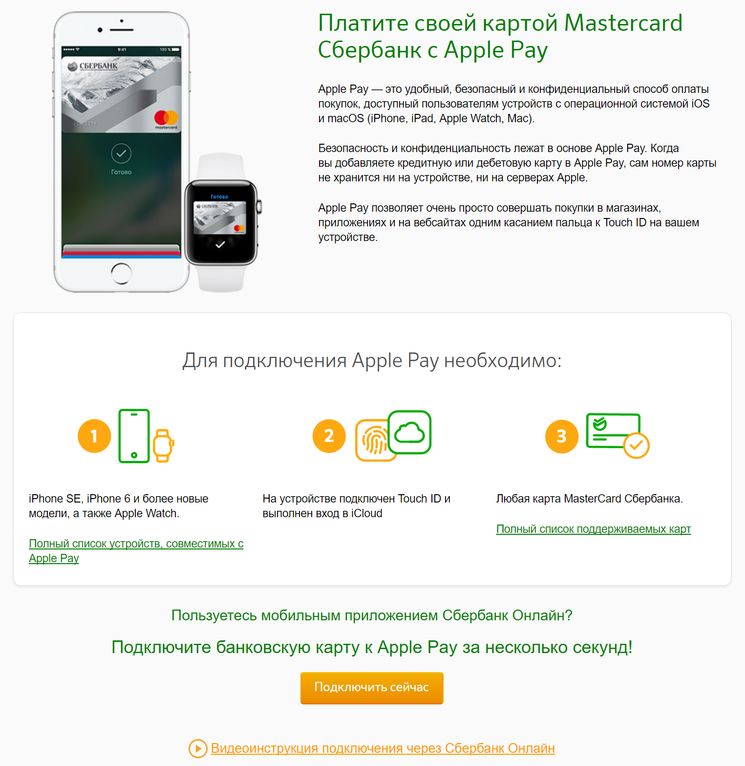

Need to correctly and quickly connect Apple Pay to a Sberbank RF Visa card? This article will help resolve this issue.

What is Apple Pay?

Apple Pay is a product of Apple Corporation. This is one of the most confidential, safe and convenient ways to pay for services and goods, which is available to all users of devices running on operating systems such as macOS and iOS.

Why will Apple Pay be a popular payment system? First of all, because the basis of its work is complete confidentiality and security. All you have to do is add your debit or credit card to Apple Pay. In this case, the user’s card number will not be stored on Apple’s servers or on the “apple” device.

When you connect to Apple Pay, you can easily make purchases in apps, stores, and sites on the web. Just touch your finger to Touch ID, which is available on your Apple device.

Before installing Apple Pay on your smartphone, you first need to know which devices it will work on.

What devices does apple pay work on?

Apple Pay can be connected to the following devices:

- iPhone 6 with Touch ID;

- Mac in Safari.

How to connect apple pay savings bank?

To set up Apple Pay correctly and quickly, your device must have a Touch ID fingerprint scanner. In addition, this device must be signed in to the iCloud service.

Important: without access to the Internet, it is not possible to set up Apple Pay. Also, in order to connect to Apple Pay Sberbank, you need to add your card to the Wallet application using an Apple device. By the way, you can connect absolutely any Sberbank card like MasterCard.

How to link a Sberbank MasterCard card to Apple Pay through the Sberbank Online app (Video)

- You need to log in to the Sberbank Online application from your device.

- Go to the MasterCard card page from Sberbank of the Russian Federation, and click on the “Connect on iPhone” or “Connect Apple Pay” button.

- Then, according to the instructions on your iPhone, you need to add the desired card to the Wallet application. To do this, it is not at all necessary to enter your personal data, enter codes from SMS messages or scan a card.

- If everything is done correctly, the status in the Sberbank Online application on the main page should change.

How to connect Apple Pay on iPhone in three steps?

- Open the Wallet app.

- Click on the plus sign in the upper right corner.

- To add a debit or credit card that is associated with an iTunes account, you need to enter the security code for the card you want to add. It is also possible to add a card by entering its data using a video camera. To do this, select “Add another card”.

Connecting Apple Pay to Apple Watch

- Launch the Sberbank Online application on your iPhone.

- Go to the Sberbank MasterCard card, then click the “Connect on Apple Watch” and “Connect Apple Pay” buttons.

- Follow the instructions on the Apple Watch to add the card to the Wallet app. To do this, you do not need personal data, codes from SMS or to scan a bank card at all.

- When the connection is made, the status of the card on the Sberbank Online application page should change.

How to connect Apple Pay on Apple Watch in another way?

- Open the Apple Watch app on your iPhone.

- Tap Wallet & Apple Pay with your finger and select Add Credit or Debit Card.

- To add a credit or debit card that is associated with the iTunes service, you need to enter the security code of the card you want to attach. Also, as an option, you can select “Add another card” and use the camera to enter the data of the card that you are going to attach to Apple Pay.

Connect Apple Pay on iPad

- Go to “Settings”.

- Then you need to select “Wallet and Apple Pay”, then click “Add a credit or debit card”.

- To add the desired card, enter its security code. Or, alternatively, select “Add another card” and maintain card data using video.

How to pay for goods and services with Apple Pay?

To pay for purchases in the store, you need to bring your iPhone to the terminal and put your finger on Touch ID. And as soon as authorization takes place (fingerprint recognition), payment for the purchased goods will occur. The terminal should give confirmation of successful payment. Do not be lazy, and make sure that the payment actually took place.

How to pay for purchases with Apple Pay (Video)

Important: For payments over 1,000 rubles, the seller may ask you to enter the PIN code of the Sberbank card in the terminal.

Recommendation: You should not enroll third-party fingerprints on your device or link them to Apple Pay.

How do I pay for a product or service in a store with Apple Watch?

- Bring your wrist with your Apple Watch.

- You need to enter a password.

- In order for the payment for the goods to pass, you must press the button on the side of the watch.

- Then you should choose a MasterCard card from Sberbank.

- Turn Apple Watch to the terminal screen.

- The transaction must complete successfully. If you have any doubts about payment, check with the terminal.

How to pay for goods in mobile applications and on the Internet using apple pay?

- After placing an order, you need to find the Apple Pay icon.

- After it is found, touch it to check the contact details, as well as your payment.

- Press your finger on Touch ID to complete the purchase. You can also make a purchase by double-clicking on the Apple Watch button on the side. The screen should light up the inscription “Done” along with a checkmark. This means successful payment.

Guide to Android Pay in Russia

Yandex. Money – card-to-card transfer MasterCard/Visa

Samsung Pay – how to connect and use? Detailed instructions

How to connect Apple Pay Sberbank. Detailed instructions

MIR card from Sberbank in your iPhone. Now it’s possible!

From July 20, 2021, MIR cardholders of the 7 largest banks have the opportunity to add a card to their smartphone. We’ll tell you how to do it

There is no need to talk about the persistence with which the government is trying to popularize bank cards for the national payment system MIR. This can be seen from the huge cash injections that have taken place over the past couple of years. What does it cost to return 20% of the cost of the tour in Russia to the MIR card.

Moreover, the MIR bank card has become a mandatory attribute for those families that receive either a pension or child and other benefits.

MIR has launched many attractive promotions that are really beneficial for cardholders. However, until now there has been a significant drawback. The MIR card could not be added to your smartphone, and therefore, in order to receive cashback or other privileges, the card had to be constantly carried with you.

Yes, there were a lot of instructions on the net on how to add MIR to your smartphone, but they were all a little cunning. In fact, it was not the MIR card that was added to Apple Pay, but a VISA (or MasterCard) card, which was tied to the same account. You could use money, but you could not receive cashback.

From July 20, 2021, the situation has changed for clients of 7 large banks:

- Sberbank,

- VTB,

- Russian Agricultural Bank,

- Promsvyazbank,

- Post Bank,

- Tinkoff Bank,

- Primsotsbank.

If you are an iPhone owner and your MIR card is issued by one of these seven banks, then today you can easily add your MIR card to Apple Pay.

Unfortunately, there is nothing to please the owners of Android smartphones. It is not yet possible to add a card to Google Pay, but there is a separate Mir Pay system – if the phone supports the NFC standard, the MIR card of many Russian banks can be linked to it, and also to Samsung Pay. And there are also rumors that something may change in the fall of 2021 , and the card can be linked directly to Google Pay.

Next, we will tell you how to add a MIR card from Sberbank to your smartphone (the algorithm will be similar for other banks).

How to add a MIR card from Sberbank to your smartphone

On the main screen in the application, select the MIR bank card that we want to add to our iPhone and press the button:

Then select the item and click “Add to Apple Wallet”:

At the third step, we only have to accept the terms of use of the service, since your card details will already be filled in:

That’s all. At the end, you can choose this card as the main one. So that for any payment, funds are debited from this card.

Adding a MIR card of other banks to the phone

In the event that your MIR card is issued by VTB, Tinkoff Bank, Post Bank, Promsvyazbank, then you can also add a card in another way – through an Internet bank or the Apple Wallet application. Find the application on your phone:

Then press the button and press :

And at the end, indicate the details that are indicated on your card (name, card number, expiration date and CVC):

Graduated from the Belarusian National Technical University (BNTU) with a degree in Economics in 2012. Incredibly diligent, responsive and attentive specialist. A true perfectionist in his field, any business he starts is brought to an end. Journalist and expert on banking products

Recommended reading

Apple Pay is the development of engineers of the famous “apple” company for the production of mobile gadgets. It is designed to replace bank cards. With the help of this technology, it will be possible to easily pay by phone wherever contactless cards are accepted. Apple Pay appeared in Russia relatively recently – since October 6, 2016. Moreover, initially a number of cards were not accepted at all, and only recently some key banks were able to connect almost all cards.

- What is Apple Pay

- What devices are supported?

- Which banks does Apple Pay work with?

- What type of cards can I use with Apple Pay?

- How to use Apple Pay?

This is a technology that has been around since September 9, 2014 that allows you to use your smartphone instead of a contactless bank card. With its help, the device can pay in stores, the Internet, applications. For this, the bank card of the owner of the phone will be used.

First of all, this is a very convenient payment method – it is absolutely safe and confidential. No one will know the bank details of the smartphone owner with this service and will not intercept the payment.

It is worth taking a closer look at how Apple Pay works and how to use it in Russia.

How does it work?

Apple Pay works as a contactless payment. Understanding how to pay with it is no more difficult than using a regular card. In order to transfer money to the store for the purchase of goods, you just need to bring the device close to the contactless card reader.

The sensing distance depends on the newness of the terminal. The older it is, the closer you will have to bring the device. The maximum possible distance is 20 centimeters.

After the contact of the phone or watch with the terminal is established, you can confirm the payment by entering the PIN code of the card or a fingerprint on the fingerprint sensor of the gadget.

More details about the technology. Apple Pay is based on NFC (Near Field Communication) and the Secure Element chip. It will store your credit card information. This is controlled using special applications and servers.

In general, Apple Pay operates through the following programs and components:

- . A repository of necessary information about the owner’s bank cards. It is here that the necessary ones are stored. The chip encrypts them in such a way that it is almost impossible to extract information from it – gaining access to the element’s memory is blocked for all applications;

- Apple Pay Servers. A server that interacts directly with the Wallet app. It manages bank cards attached to the wallet and is responsible for encoding payment data;

- . A component that is responsible for starting the authentication process on every attempt to transfer money. Stores in its memory the fingerprint of the owner of the smartphone.

It is important to remember that not every terminal can support Apple Pay. In some cases, they are no longer able to work with new technologies.

You don’t need an Internet connection to pay for purchases. All the necessary data is stored in the smartphone itself. You only need to connect to the network once, the first time you log in to the Wallet app.

How much does it cost to use the technology?

Using the service in the country is absolutely free. Neither Apple nor Russian banks require money for connecting contactless payments and paying for purchases using mobile gadgets. The Wallet application, which is required for linking bank card data, also does not cost a single ruble.

Moreover, there is no commission for payments either.

In fact, when paying via Apple Pay, the terminal accesses the bank card directly. And when paying through the store’s terminal in the currency with which it works, the commission is not paid. Same here.

Why is it convenient?

This payment service allows you to say goodbye to the fear of accidentally losing your bank card. All the necessary data will be immediately in the smartphone, which will greatly simplify life. In addition to the device, you will not need to carry a wallet with a compartment for cards. Of course, it takes up little space, but it is also easier to lose it.

Apple Pay is a guarantor of additional financial security for several reasons:

- The phone is much harder to lose. The loss of a thin card may not be noticed immediately. And the phone is always at hand. And in the terminal, you can’t accidentally forget it either.

- each payment will not allow you to simply take and withdraw money from the account. You will need to at least know the password from the phone or be able to attach the fingerprint of the owner of the device.

- No need to carry a wallet with you. And this saves space and increases convenience.

- from one to eight cards will eliminate confusion. The necessary data can be viewed immediately in the application on the smartphone.

Contactless cards using the same technology cannot be called as secure. Data from them can still be read if the card itself is stolen. And the lack of authentication by phone password or fingerprint allows you to withdraw 100-200 rubles each (they do not need confirmation with a PIN code).

Unfortunately, the technology is not supported everywhere in Russia. But in a few years, you won’t have to worry about whether the nearest store will need a card or cash.

What devices are supported?

As the name implies, the service is supported by Apple devices. But even in the case of branded products, the scope will differ depending on the generation of technology. You can pay for purchases without restrictions only from the following gadgets:

- iPhone 5SE;

- iPhone 6/6 Plus and updated S series;

- iPhone 7/7 Plus;

- Apple Watch (paired with iPhone 5/5 and older).

All other devices, starting from the iPhone 5, can also act as a means of payment. But only on the Internet and the Apple Store.

Analogues for other devices

However, if the original Apple Pay is available only to the products of this company, then Android smartphone manufacturers have created a similar technology. Today there are several analogues:

- Samsung Pay. In addition to the standard use, NFC supports MST technology, which simulates the magnetic tape of the card and therefore makes it possible to pay at any terminal). Installed exclusively on Samsung gadgets;

- Android Pay. Works only via NFC with all smartphones on Android OS.

Analogues work almost the same as Apple Pay. The degree of protection and safety of use do not differ from the “apple” version. Therefore, owners of smartphones on Android are not infringed on their rights.

Which banks does Apple Pay work with?

In order for the new contactless payment technology to come to Russia, leading banks had to conclude contracts directly with Apple. It is noteworthy that on the day the system was launched in the country, Apple Pay received support only from Sberbank. He was also able to build the best work with the payment service, being the first to support almost all types of cards, except for American Express.

Today you can use Apple Pay if you have a card from the following banking institutions:

Naturally, this list will be supplemented in the future. Many banks are planning or are already in the process of entering into an agreement with Apple to be able to connect their cards to their servers.

In addition, you can additionally connect Yandex. Money” and QIWI, as well as the Internet Banking card of the mobile operator “Beeline” in order to be able to pay with them in stores and on the Internet.

What type of cards can I use with Apple Pay?

It is important to remember that each Russian bank may have its own set of supported cards. Therefore, the question must be clarified directly in each institution separately.

Initially, Apple Pay supports cards of leading payment systems:

- American Express;

- MasterCard;

- Visa.

They also function in Russia. But not all brands and types of cards inside them support banks. Mostly they use MasterCard and Visa cards. But instant ones, such as Maestro, are not supported. And not everyone works with Visa Electron.

Apple Pay works great with both debit and credit cards. It is enough that they have money (or a credit limit) to be able to pay for the purchase.

How do I use Apple Pay?

To be able to use the new way to pay for purchases in stores and online, you must first understand how to connect Apple Pay. To do this, you need to configure the existing gadget and connect a bank card to it.

How to connect/disconnect the card from the system?

To get started, you will need to set up the Wallet application on the gadget you are using. It is designed to store and use bank card data, discount and bonus cards, and other information.

Authorization will be required at the first launch. To do this, you need to remember your Apple ID password.

Immediately after authorization, the user will be prompted to start using Apple Pay. In the corresponding window there will be text, and below it there will be a button “Add a payment card”, which you must click on.

Now there are two ways to add the card with which the smartphone owner intends to use Apple Pay to the Wallet database:

- Take a picture of her. To add a card, you need a camera, so if your smartphone has a protective case that covers it, you will have to remove it.

- Enter all data manually.

After entering the information in one way or another, you will need to confirm the operation. As a rule, you receive an SMS message with a special password. This password must be entered into the Wallet app to activate the linked card. If everything went well, there are no errors in the data – the phone will report success. After that, the card can be safely used.

By the way, Sberbank allows you to use a simpler method of linking plastic to Wallet. For this you need:

- Connect Mobile Bank to the card;

- Tap on the plus sign in the upper right corner;

- Enter the security code of the card (if it is associated with iTunes).

After this simple procedure, the card is linked. You don’t need to take a picture of it or type in the data yourself. Sberbank and Wallet will independently exchange information.

You can also use Sberbank Online:

- Open the page of the bank card you want to connect in it;

- Tap on “Connect Apple Pay” (instead of Apple Pay, iPhone / Apple Watch can be written).

- Follow the instructions provided by the bank.

VTB 24 Bank (and others) does not provide other connection methods. Therefore, you will have to take a picture of the card or enter information from it manually.

Where to pay with Apple Pay

The developers have provided the following places where you can pay for goods and services:

- Shops with contactless payment terminals;

- Purchase of goods and services on websites and online stores;

- Payment for services in programs (for example, the purchase of game items);

- Using a bonus card (it is added in the same way as any other).

In fact, the system covers all possible places, except for transport, where money may be needed. This eliminates the need to carry one (or several) bank cards and cash with you.

It is important to remember that when paying online or when buying something in the application, you will need to find a payment method through Apple Pay. Otherwise, this online store or program does not support this technology.

What about security?

Many users doubt whether it is safe to use the contactless payment service at all, especially with a smartphone. These doubts are caused by distrust of new opportunities. There is always a fear that at some point during the transfer of data, information about the card or the money itself will be stolen. But you don’t have to be afraid of it. Now we will debunk a few myths and explain why they are not true:

- Card data will not be transferred to third parties. They are encrypted and stored in an inaccessible sector of the device’s memory. Only the owner of the device can view them.

- The PIN cannot be stolen. Because he is not needed. For payment, only the fingerprint of the owner of the phone is used.

- If you lose your smartphone or watch, your card data will not be in danger. First, to use it with the Apple Watch, you need to set a password on the Wallet app that no one will know. Secondly, authentication from a smartphone (as already mentioned) passes only through a fingerprint.

- Apple does not receive any data from the Wallet app. Information is not transmitted to the Internet and is not sent to the company’s servers. It is encrypted immediately after entering and is stored only in this form.

- Viruses and any applications in general cannot get inside the Wallet. As already mentioned, data is stored in an isolated memory sector. It’s impossible to get to them.

That’s why Apple Pay is one of the safest payment methods. There is no need to worry about money, because it will be protected not only by passwords and the attentiveness of the owner, but also by modern technologies.

Apple Pay reviews

More than half a year after the launch of the system in Russia, users managed to draw the following conclusions:

- Apple Pay is convenient. People note that they no longer have to carry cards with them or be afraid for the safety of money.

- Contactless payment is faster than with a regular card and cash. It is enough just to bring it to the terminal and hold your finger on the fingerprint sensor.

- There are no mistakes when making a payment. If the terminal is working, and its connection with the bank is stable, there will be no problems.

- The payment notification system allows you to keep track of your spending. If one card is connected to several devices at once, a notification will immediately be sent to another about spending money on one.

In general, users were satisfied with the new way to pay for purchases, goods and services. It is only important not to tell anyone the Wallet and iPhone lock code.

Sberbank customers can quickly connect Apple Pay via Sberbank Online. The service is ideal for paying for goods and services, in stores or online. Contactless payment technology is available to owners of iPhones, iPads, Apple watches and MAC computers. It provides convenience and saves time.

Description of the work of the Apple Pay service with Sberbank

The service works with Visa and MasterCard cards (debit and credit).

The advantage of the service is that you do not need to carry a pile of cards with you, it is enough to have an Apple gadget to pay for goods and services. After linking a payment instrument, transactions can be performed in one click.

You can upload several Sberbank cards to the service.

Binding

To link a payment instrument, you can use Wallet or Sberbank Online.

Via Wallet

To add a banking instrument through Wallet, follow:

- Start the program.

- Go to the payment section and click “Add”, click on the confirmation and further.

- Scan a card or enter the required information yourself.

If all the data is entered correctly, then you can start using Apple Pay.

With the help of Sberbank-Online

IPhone owners should follow the following instructions:

- Select the required card in Sberbank Online.

- Click “Connect to IPhone” next to it.

- Pay attention to the card status status.

After the completed actions, “Added to Wallet” will be written.

Instructions for Apple Watch

The connection process for Apple Watch is as follows:

- Open the smartphone settings and launch the smartwatch control app.

- Go to the list of functions and select “Wallet and Apple Pay”.

- Link a Sberbank card, and if it already exists, then the “Add” button will be on the right. If not, then you should click on adding a payment card and enter the required information.

- After agreeing to the privacy policy, it is important to activate the program using the SMS code that will be sent to the smart watch.

At this point, the download can be considered complete.

If you successfully add a Sberbank card, you can pay for goods and services through the gadget.

How to use Apple Pay in stores

For those who decide to use the service at a point of sale, the actions are as follows:

- You need to come to the store with a smartphone with a customized program and decide on the product.

- Select a card from Sberbank for payment in the Wallet application.

- If the phone has the NFS function, you only need to take the phone and bring it to the terminal. The finger should be applied in such a way that the Touch ID sensor can recognize the papillary pattern.

The above actions are enough to make a payment.

You can use your Apple Watch with two presses of the side button. Select a bank card from the list and bring the watch to the terminal display.

Online and App Payments

The service is available for paying for goods on the Internet. The procedure must be carried out at the time of placing the order. For payment, there is an icon that provides information that the site has the ability to deposit money through the service.

You will need a fingerprint for authentication. If you have a smart watch, then just press the side button.

If the procedure was carried out successfully, then after the completion of the transfer of money, the inscription “Done” will appear. You can also see a mark that the funds have been successfully transferred.

Users should remember that the process of connecting a Sberbank card to Apple Pay is not accompanied by any difficulties for customers.

To carry out the procedure as quickly as possible, you must follow the instructions.

If you have any difficulties using the service, you should contact the support service.

What are the payment limits

Users will be interested to know that they can use the service for free. There is also no limit on payment for goods and services.

There is only one caveat: if a user has made an order in the store for more than 1000 rubles, he will be asked to enter a PIN code that he uses to pay or leave a signature on the receipt.

Privacy & Security

Apple Pay is an absolutely safe service for paying for goods. The service uses only an individual phone number and a unique transaction code. The number will not be stored on the device and servers, will not be transferred to sellers during payment.

After using the card with Apple Pay, no customer activity data will be saved. There will be no information about the transaction by which the client can be identified.

Feedback on the work of Apple Pay from Sberbank

Clients are satisfied with the work of the service, the absence of commission for use. Therefore, Apple Pay is recommended to others.

Conclusion

Contactless payment greatly simplifies the life of users. No need to carry cards and cash. The Apple Pay service allows you to deposit money for goods in stores or via the Internet. It is enough to link a card from Sberbank and use it for its intended purpose. Confidential information about the client is not stored, so the service is secure. It can be connected not only to a smartphone, but also to a Mac computer, iPad, smart watch.

https://youtube.com/watch?v=tplI3hZrXPE

Russia became the 10th country where Apple Pay came in 2015. Now, most adherents of apple technology pay with an iPhone instead of a bank card. And all thanks to such banks as Sberbank, Tinkoff, VTB, Alfa-Bank, which were the first to introduce contactless payments with mobile service support. Such prevalence makes many people enlighten and learn how to pay with an iPhone instead of a Sberbank card or payment instruments of other financial organizations.

What is Apple Pay and service features

Apple Pay is a mobile application that allows you to pay with an iPhone instead of a card. Thanks to the built-in chip with NFC technology, the mobile phone can read data and transfer it to the payment terminal in encrypted form.

Thanks to the service, you can:

- pay with an iPhone in a store;

- pay for purchases on the Internet;

- download paid apps;

- save on commissions;

- buy electronic currency;

- use store coupons (discount, savings, coupons);

- pay the fare and buy tickets.

Paying with an iPhone instead of a card is completely safe:

- no one will be able to use linked payment methods without using Touch ID;

- the seller does not see information about the card (it is only inside the application, and the receipt displays a random order of numbers generated by the program);

- if the gadget is lost, you can delete all the data yourself through remote access;

- You can pay for a purchase worth more than 1000 rubles only by additionally confirming the action with a PIN code.

Otherwise, Apple Pay is just convenient. In a large city with a developed infrastructure, you can forget about the ringing change in your pocket, and you can leave your wallet at home. You only need an iPhone.

Requirements to pay with Apple Pay

To use contactless payment with your iPhone, you need a little:

- iPhone model must have an NFC chip (starting with SE, ending with XR and the next novelties);

- have a Visa or Mastercard from an Apple partner bank;

- the payment terminal must support NFC technology;

- log in to iCloud;

- be over 18 years of age.

Additional information. iPhone 5 and 5 S owners can use contactless payment by pairing with their Apple Watch.

What Sberbank customers should know before connecting Apple Pay

In 2019, according to Forbes, Sberbank took first place in the Best Service nomination. The bank was the first to connect Apple Pay to its Mastercard cards. Now all payment means of the bank work with the mobile service, except for MIR and Maestro. Domestic Russian cards with a foreign service do not work.

Linking a Sberbank card using the Sberbank-Online application

When issuing any Sberbank card, employees always ask to install a mobile application. Sberbank-Online is multifunctional. You can track expenses, transfer money between means of payment, pay for purchases in the online market, etc.

To pay with an iPhone instead of a Sberbank card, the payment instrument must be linked to Apple Pay. This can be done through mobile banking. If not, Sberbank Online is always available in the App Store.

The next instruction is:

- Go to the “My cards” section. There should already be a payment method that is attached to the account.

- Select the payment method you want to connect to Apple Pay.

- In the menu at the bottom there will be an item “Connect Apple Pay”.

- Next is Sberbank iPhone.

- Accept the user agreement.

Pay attention! If you need to create a link with iWatch, you need to do everything in the same way, only by going to “Connect Apple Pay”, select “Sberbank Watch”.

How to upload a card to Apple Pay through the Wallet app

Traditionally, any contactless payment bank cards or discount coupons are loaded into the Wallet application.

To link a payment instrument from Sberbank, you need:

- Launch Wallet.

- In the upper right corner, find and click on the “+”.

- In the pop-up window, click “Next”.

- Make a scan of the card or enter details manually.

- Enter CVC code.

- Accept the terms of the user agreement.

- Confirm the binding with a code from SMS from Sberbank.

- Click “Done”.

Pay attention! Before binding, you need to make sure that the account has more than 30 rubles. To set up a payment instrument, the service will withdraw this amount from the account and return it back.

Pay for purchases with Apple Pay

After linking, you can pay for purchases in any store that has contactless payment for Visa or MasterCard. For this you need:

- Tell the cashier that payment will be made through the terminal.

- Wait until the reading device displays the purchase amount and says “Insert card”.

- After that, it is enough to activate Touch ID and bring the iPhone to the terminal at a distance of up to 10 cm.

- Hold the phone in this position until “Done” is displayed on the screen. The transaction time is generally less than 5 seconds.

- After that, the cash register will start printing a check, additionally confirming that the payment has passed.

Important! The money will be withdrawn from the card that will be indicated on the iPhone screen. If several payment instruments are added, then you should select the required one manually. By default, funds are debited from the first installed card. You can change your current payment instrument in the Wallet app.

To return an item paid for with Apple Pay, the seller will need to dictate the numbers that the application displayed on the receipt instead of the actual card details.

Is there a fee for using the service

There is a commission for using the service. But it is immediately worth noting that no one earns on it. Apple does not charge fees from its users, only from banks.

Financial institutions connect the service to become more attractive to customers, and the commission is needed to pay for work with Apple Pay. So, when paying with debit cards, you will have to pay 0.05% from each purchase, and 0.12% from a credit card.

Benefits of contactless payments

No wonder every bank in any country strives to issue contactless cards and become an Apple Pay partner. There are really many advantages of paying by phone:

- Payment is faster. You don’t even need internet for this.

- There is no need to enter a pin code if the check is less than 1000 rubles. And to identify the owner, a fingerprint is suitable, which is already in almost every phone.

- Of course, losing a phone is a shame, but not dangerous. You can delete all cards remotely. And if you lose your wallet, then you need to call each bank and ask to block the means of payment. Plus, there is no way to return the cash in the wallet.

- No risk of card failure. That it will break in your pocket or the tape will demagnetize.

- Merchants no longer have access to card data. What they get is actually ciphers generated by the service, not actual credentials.

- There is no danger that someone will steal the data with a skimmer.

Also, contactless payment completely replaces cash, freeing up pockets. There is no need to look for small things. Plus, money is one of the main carriers of pathogenic bacteria.

Sberbank was the first in Russia to connect Apple Pay and has a wide range of various payment methods compatible with the virtual service. To pay for purchases with a Sberbank card via your phone, you need to install online banking, activate Apple Pay in the settings of the payment instrument, or simply add the payment instrument through the standard Wallet application.

You can link a card to an iPhone in a couple of minutes, sometimes even faster. It is important to carefully enter all the data and check whether the bank really cooperates with Apple Pay and whether a specific card is supported. Residents of different countries can pay using iPhone.

NFC Expert

NFC Expert