What is the cash withdrawal limit from a Sberbank card

PJSC Sberbank, like all credit organizations, sets a certain limit on cash withdrawals from a bank card. The level of restrictions depends on the status of the client’s card.

More about limits and why they are needed

Cash withdrawal limits from Sberbank cards

Mobile phone billing restrictions

Limits for electronic wallets

Other limits and restrictions in Sberbank

Features of receiving money at the bank’s cash desk

More about limits and why they are needed

Bank limits – this is the maximum amount that a client can withdraw in cash from an ATM or through an office. Restrictions are set on cashing out money in one operation, per day, per month.

Reasons for setting restrictions:

- Minimizing the risk of fraud and illegal cash withdrawals;

- Credit cards: the introduced restrictions encourage the client to use the banking product in the form of a universal means of payment.

Cash withdrawal limits from Sberbank cards

For all types of cards, Sberbank sets certain limits. The higher the status of the card, the higher the maximum amount that the client can withdraw.

Note! For credit cards, cash withdrawals do not fall within the grace period and interest for the use of funds is accrued from the date of withdrawal.

Daily limits

Sberbank PJSC has set the following limits on cash withdrawals through ATMs per day for debit and credit cards:

For cash withdrawals through Sberbank cash desks, amounts in excess of the daily limit are subject to a commission of 0.5% of the amount.

Note! For Momentum cards, a commission of 0.75% is set for cash withdrawals at an office or ATM, regardless of the amount.

Limits per month

The Bank has set the following limits on cash withdrawals through ATMs per month:

Note! There are no limits set for cashing out funds through offices and ATMs of third-party banks. With MIR cards, this operation is not performed.

Mobile phone billing restrictions

To pay for cellular communications through the Sberbank online system, there is a limit on the amount of transactions per day – no more than 10,000 rubles. If the limit is exceeded, the system will issue a warning. The transfer of funds can be carried out only after confirming the actions by calling the contact center (the phone number of the call center is indicated on the bank card). The limit of transactions with confirmation is 500 thousand rubles.

Payment for mobile phones through a mobile application: transaction limit without confirmation in the contact center: 9510 rubles; with confirmation: 499510 rubles.

Limits for electronic wallets

When using the Sberbank online system, replenishment of electronic wallets is available only from bank cards. For the operation of replenishing wallets, the following limit is provided: no more than 10,000 rubles per transfer.

Note! The minimum amount of replenishment is also set – 50 rubles.

Sberbank clients can link their card to Yandex. Wallet: in this case, the card will be replenished automatically within the amount required to pay for the goods or services.

Other limits and restrictions in Sberbank

For security purposes, there are additional restrictions for money transfers by phone number:

- 8000 rubles per day – the maximum amount of transfers. The limit is set for both the sender and the recipient;

- 10 transactions per day – the maximum number of transfers.

Note! There are no restrictions on transfers to individuals through territorial offices

For transfers of funds by individuals, a commission is provided:

- 1.5% when transferring to another client to a debit card outside the same city – maximum 1000 rubles;

- 1% when transferring to another client to a debit card of another city through the Sberbank online system – 1% of the amount (maximum 1000 rubles).

Note! Transferring funds to a credit card is free of charge.

Peculiarities of receiving money at the bank’s cash desk

When contacting a bank branch, you must have a document confirming the identity of the account holder. Within the established limits, cash will be issued immediately.

If you need to receive a large amount of cash from a bank card, you must first write an application for ordering funds. Within a few days, a bank employee calls the client and sets the date of issue. First of all, this operation allows you to minimize the risks of fraud – the money will be issued in a separate closed room. In addition, the bank needs to prepare the necessary amount of cash for issuance.

3 minutes – 3 days

MFC Lime-Zym (LLC)

LLC MFC “Money Men”

OOO MCC Akademicheskaya

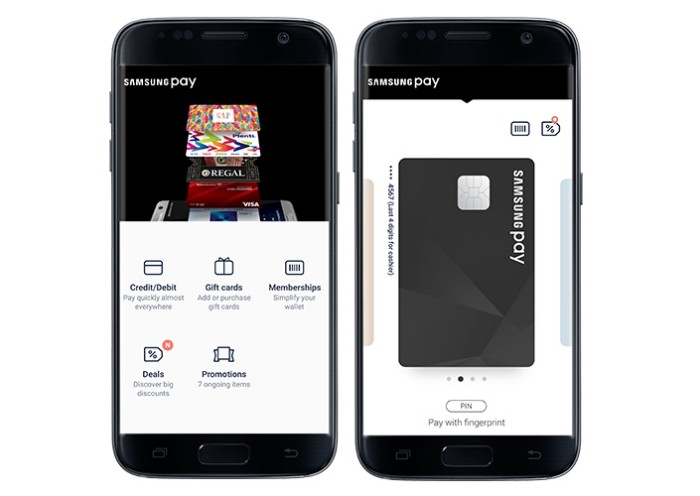

Modern technologies make it possible to pay for goods and services without cash or even a credit card. This can be done directly from your smartphone using mobile payment systems such as Samsung Pay. How does the Samsung Pay system work and how to connect and use it in the future?

Samsung Pay is a mobile payment system developed by the popular Korean manufacturer Samsung. Its main feature is the ability to make payments through payment terminals directly from the phone. This is ensured by the presence of MST technology in modern Samsung smartphones. Thanks to it, the smartphone generates an alternating current, creating a field capable of dynamic changes. It operates at a distance of about 8 cm from the reader.

In addition, work is provided by NFC technology, which allows contactless payments. The system works as follows: the user adds his card data to a special application, and in the future he can pay for purchases only by bringing his smartphone from the terminal. Transactions in this case take place in the same way as when paying directly with a card.

Of the advantages of the system, the following should be noted:

- It eliminates the need to carry a card. The phone is usually always at hand, and it is much more convenient to pay with it. This is the most obvious advantage, but there are others, no less significant.

- Payments are secure. When making a payment, the payment terminal receives encrypted data, which cannot be stolen. Payments are confirmed by a fingerprint, which is unique for each person.

- The developers have done everything to ensure the protection of the user. For this, the KNOX service is used. It is an antivirus built into a smartphone and makes sure that card data is not stolen.

- The service also monitors the correctness of transaction processing. But the user also needs to be vigilant. Before making a payment, you need to pay attention to the debit amount.

- An important advantage of the system compared to its competitors is the ability to make payments at any terminal, not just the one that supports contactless payments.

- The service is simple and easy to use. To start using it, you only need a smartphone that supports the appropriate technology and an installed application of the same name.

As already mentioned, the unique technology allows the service to conduct transactions on two types of terminals at once:

- Magnetic. They are used by conventional terminals for carrying out operations with plastic cards.

- Wireless. These types of payments are supported only by special devices that work with NFC technology.

Work with NFC technology in Russia is not developing very fast, and not all retail outlets have such terminals. This makes the system universal. Two types of transactions at once are supported by a universal magnetic chip that smartphones are equipped with. In view of this, the device is recognized even by the most common terminals.

The company has carefully considered everything regarding the security of the service. Appearing errors and bugs are eliminated extremely quickly. When working with magnetic terminals, the already mentioned chip, which generates a one-time code, provides protection. The terminal will thus read not the card number, but the sent number, which is of no value to attackers.

When using enhanced NFC, streaming data encryption is supported, as well as the SE algorithm, so hacking and unauthorized access attempts on the card are recognized very quickly.

We invite you to watch a video about how Samsung Pay works:

https://youtube.com/watch?v=lF0ru3bWaiY%3Ffeature%3Doembed

How to use, algorithm step by step

To use the system, the owner of a Samsung smartphone needs to add bank card details to the application. Later they get into Samsung Knox and remain encrypted there. Before making a payment, you need to select the required card and access it by providing a fingerprint or entering a pin code. The gadget must be brought to the terminal and wait until the transaction is completed.

The magnetic emitter built into smartphones operates at the same frequency as plastic cards. The terminal treats the phone like a card and makes the transaction in the same way. You can pay for goods and services not only through terminals that support NFC, but also through ordinary, more outdated devices.

When paying, the smartphone does not send the card data to the terminal, but a sixteen-digit code called a token. Therefore, there is no risk of interception of data by fraudsters. Even if they receive the token, they will not be able to do anything with it, because the system will block it if they use it again.

Each operation can be confirmed not only with a password, but also with a fingerprint. The latter option is more reliable, since the print cannot be faked. If the system suspects a hacking attempt, all data that may be useful to scammers will be deleted: card numbers, history of financial transactions, and so on.

We invite you to watch a video on how to use the Samsung_Pay application:

https://youtube.com/watch?v=3R05uv30Coo%3Ffeature%3Doembed

List of supported phones

Samsung Pay currently allows contactless payments from the following smartphones:

- Samsung Galaxy: S7 and S7 Edge, S8, S9.

- Samsung A3, A5, A7 2016 and 2017, A8, A8+.

- Samsung Note 5, Galaxy Note 8.

- Samsung Galaxy J5 and J7.

- Samsung S6 Edge.

On the last two smartphones, only NFC is used for payment. Samsung Gear S2 and S3 smart watches can also be used. It should be noted that the payment service only works on smartphones with official firmware that has not been rooted and modified.

What do you need to connect?

In order to use the system, you need to do a number of simple steps: install the application, set some settings and link cards. It is worth understanding more about how this is done.

Install, register and set up

- Open Settings on your phone, then Accounts.

- Next, “Add account” is set and Samsung account is selected.

- Next, you need to go to the smartphone options and select the “About device” item.

- Press “Software Update” and select “Update”.

- When starting the update, you need to wait for the process to finish.

Update required. Since the system requires the latest version of the operating system on the phone.

Next, the download and installation of the software product itself begins:

- You need to open the Google Play store and find Samsung Pay in it.

- After downloading, you need to find the application shortcut on the phone screen and launch it.

- It is also necessary to come up with a pin code and use it in the future to confirm transactions.

Gadgets

To use technology, you need a gadget that supports it. Their list is listed above. At the same time, some models have only partial support for payment using NFC technology. Most of the latest devices provide MST payment technology.

Please note that Samsung Pay only works on Samsung phones.

What cards are supported?

Please note that the software does not support all cards. They must belong to specific payment systems. In addition, the bank must be a partner working with the payment service. The list of banks includes almost all major financial institutions.

MasterCard

You can link cards that work on the MasterCard payment system. They are issued by such banks as Alfa-Bank, Tinkoff, VTB-24 and so on.

VISA

VISA cards are also supported. In Russia, they are issued by a wide list of banks.

Virtual cards

Russian users can use Yandex virtual card for payment. Money, which can also be added to Samsung Pay.

It should be noted that Maestro and MIR cards cannot be used in this system.

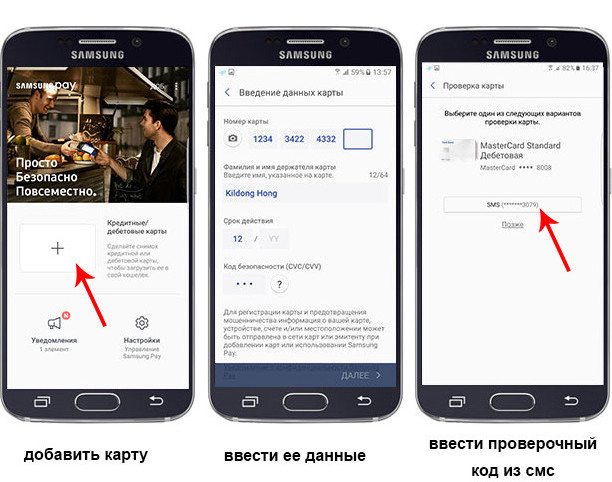

Link to smartphone

After installing the application, you need to link a card to your phone, from which funds will be debited when paying for goods and services.

This is done as follows:

- You need to launch Samsung Pay and enter the PIN code you created.

- Next, you need to click on the map icon or on the “Add” button.

- You can take a picture of the card or enter its details in the appropriate fields.

- Click “Next” and read the agreement.

- The last thing to do is to sign on the screen of the gadget.

It takes about ten minutes to register payment information. If it doesn’t pass, you should contact the bank. The problem may be in the card – perhaps there are restrictions that make it impossible to use it for payments of this kind.

Contactless payment technology

After the application is installed and the cards are added, you can use the technology for contactless payment. It is applied quite simply:

- Swipe up from the bottom of the screen or open the Samsung Pay app.

- Next, you need to log in using your fingerprints or pin code.

- The phone is brought to the terminal after the payment pending message appears.

- It remains only to wait for the successful completion of the operation.

There are no fees for using Samsung Pay. Also, no internet connection is required at the time of payment. Authorization is carried out using a smartphone. Therefore, in this way, you can make payments abroad, while in roaming, and even if there is no SIM card in the phone.

We offer you to watch a video about the nuances that may arise when paying using the application:

https://youtube.com/watch?v=whljLCksgvM%3Ffeature%3Doembed

Problems that may arise during work?

The Samsung Pay service is very easy to use and easy to deal with. However, users may experience certain problems and need to know how to fix them.

If you forgot your password

The issue of password recovery may become relevant if, when linking the card, the owner chose only one method of identification – entering a digital code. In accordance with Samsung’s security policy, it is impossible to recover or change the password of the payment system. If there is a problem, you can use the following path:

Data can also be deleted via factory reset, but this is a very complicated method, since in the future you will need to restore the data of all applications, reconfigure calls, backgrounds and other functions.

In order not to forget passwords, it is better to write them down and store them in an inaccessible place. Fingerprint identification is considered more reliable and effective.

What should I do when I failed to connect to the server?

Why doesn’t Samsung Pay work at all or can’t connect to it temporarily? Consider a number of main reasons:

- If you get an error when connecting to the Samsung Pay server, you can try using it later or restart your phone.

- The reason for the inability to connect may be that the phone does not support the technology in principle. In this case, the situation cannot be changed, since the device is simply devoid of the components necessary to perform such operations.

- Another possible reason why Samsung Pay does not start is if the phone turned out to be “gray”, that is, the official place of its sale is not Russia. You can solve this problem by going to a service center, where specialists will change the region through the appropriate programs, and the phone will begin to support contactless payments.

- In addition, Samsung Pay may not work if the phone has been reflashed. Nothing can be done in this case.

- If the problem is directly in the application, you can try reinstalling it, restarting your smartphone, or installing updates. The smartphone may itself offer to install the latest version of the software, or the user must do this on his own initiative.

The program is not updated

If the program does not update, you can try to do it again after a while.

Sometimes you need to reinstall it completely. It is also worth making sure that no actions have been taken with the smartphone that may affect the inability of the software to work.

Lockout due to unauthorized modifications

A message of this nature may appear on rooted smartphones. Devices that have unrestricted access to the file system are simply not allowed to use the service. It is not yet known if this restriction will be removed. So far, users have to choose between root access and convenient fast payments.

Samsung Pay greatly simplifies the life of the owner of the phone, allowing you to use it instead of a card or wallet. Making financial transactions with this service is convenient and safe. The only downside is that not all Samsung smartphones support the technology.

A smartphone is a multifunctional device that can be used for a variety of tasks. In particular, the device can act as a means of contactless payment for purchases, thereby relieving its owner of the need to constantly carry a wallet with him. We offer you to figure out how to install a bank card on your phone on the Android operating system, and what is required for this.

- Which phones can be contactless paid

- Applications for card connection

- Possible problems

- Risks of paying by phone

Which phones can be contactless paid

Unfortunately, contactless payment for purchases is not supported by all smartphones. The main requirement for this kind of device is the presence of an NFC sensor. Today, even budget models are equipped with it, but there is still the possibility of its absence. Therefore, it will not be superfluous to check whether your device really has NFC.

How to check your phone

NFC is a small plate that is located under the cover of the smartphone. It is with the help of this sensor that the user manages to set up payment for purchases, however, disassembling the device to check for a chip is far from the most rational option. Therefore, it is proposed to check whether the phone supports the function in the following ways:

- study the characteristics of the device on the manufacturer’s website, if NFC is available, the sensor is always indicated in the “Wireless networks” section;

- install the AIDA64 application on your smartphone, which allows you to check all the characteristics of the device, including the NFC chip;

- lower the notification shade to check if there is an “N” here, symbolizing the presence of a sensor, or get the necessary information through the phone settings.

All of the above methods have a sufficient level of convenience and simplicity, so you should not have any difficulties when performing NFC verification. As a last resort, you can always check the information on the Internet or set up a function without a preliminary step.

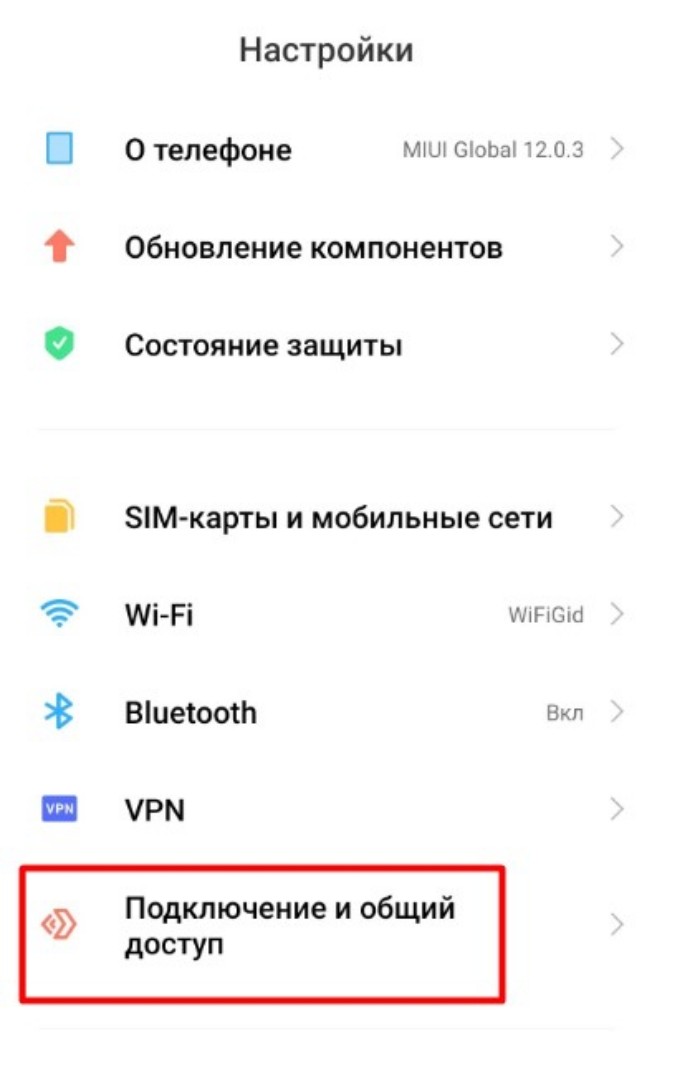

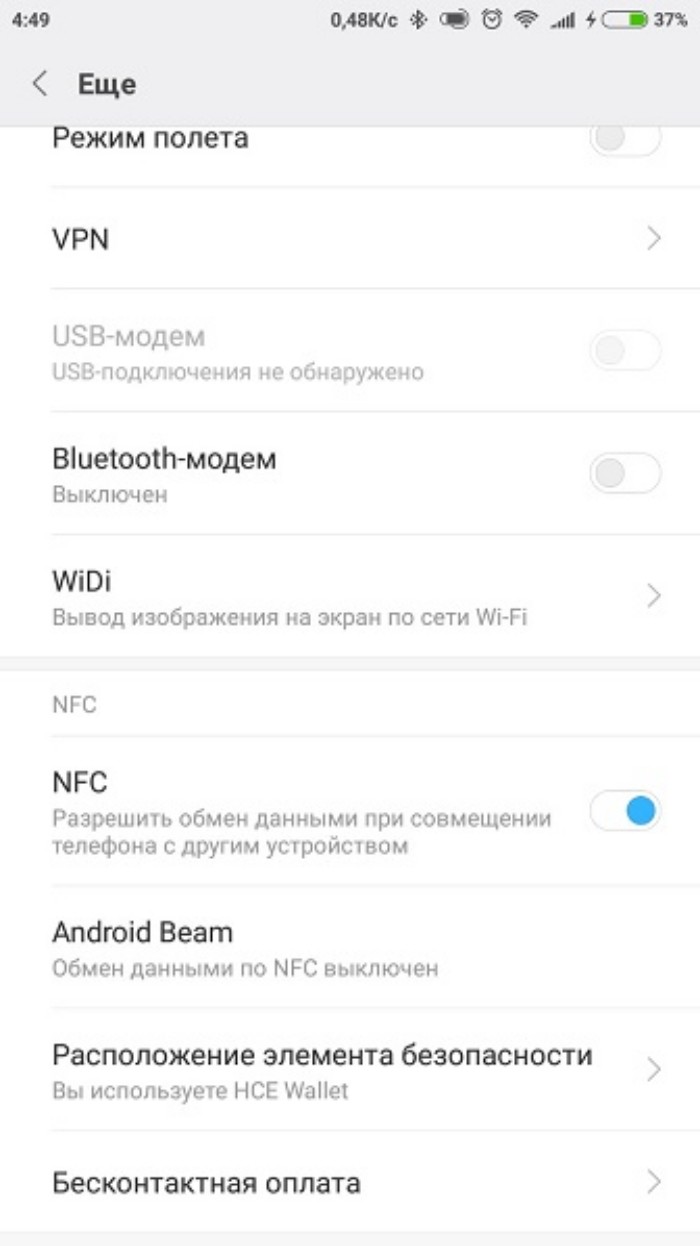

How to enable NFC

NFC, like other sensors that a smartphone has, can be enabled or disabled. Of course, paying by phone only works if the NFC chip is active. To activate it you need:

Also, NFC is turned on and off through the notification shade, where the corresponding icon is presented. However, one activation will not be enough for you to start contactless payment for purchases. Next, you need to add a bank card to the payment application.

Applications for card connection

So, after activating NFC, you will have to take care of choosing a special application for contactless payment for purchases from your Android smartphone. We offer to consider some of the most popular programs, some of which are installed on the phone by default.

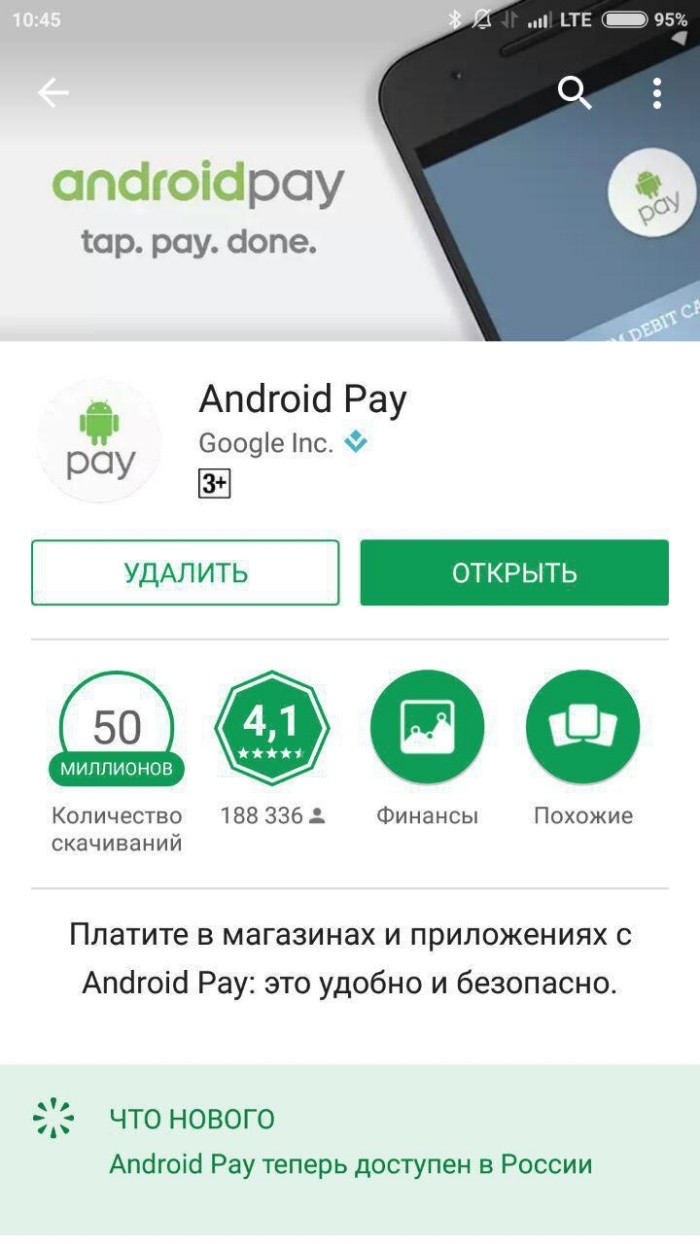

Google Pay

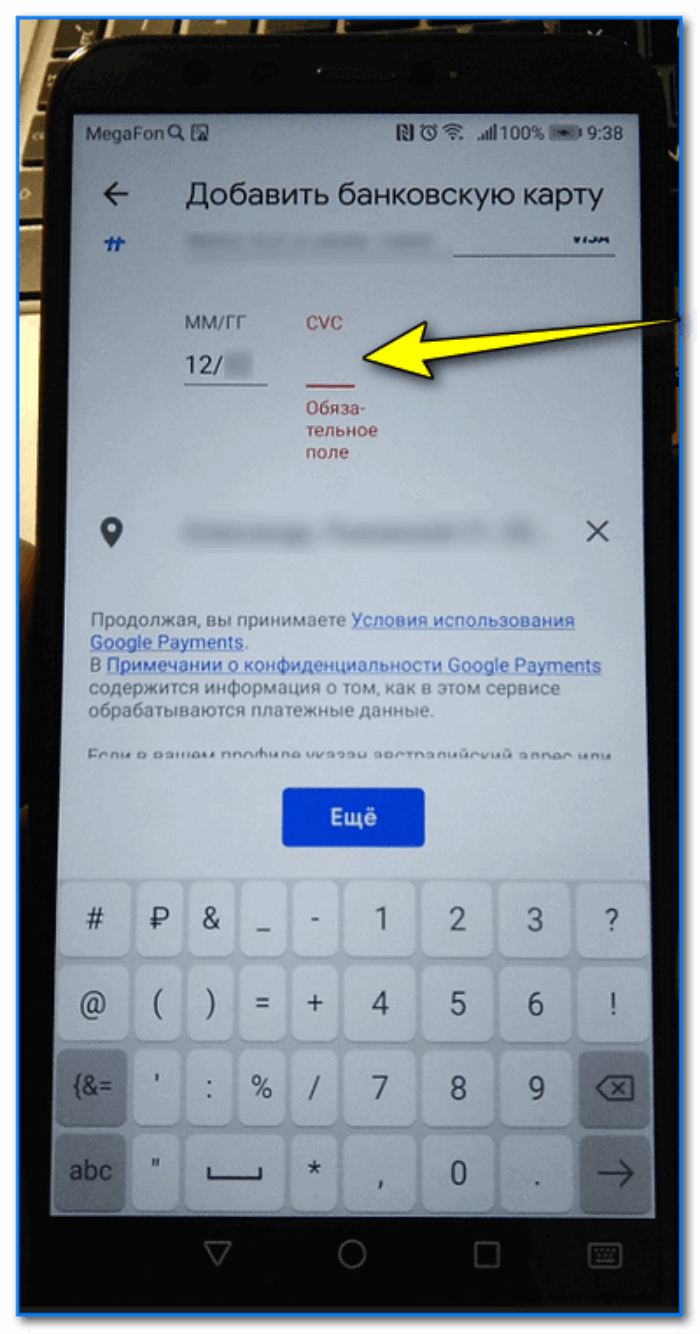

Google Pay is a standard application for devices based on the Android operating system that allows you to link a card and pay for purchases using your phone. With a high degree of probability, it is already on the main screen of your smartphone or in the Google folder. Adding a card is as follows:

- Go to the “Cards” section.

- Press the “+” button.

- Tap on the “Get Started” icon and then tap on “Add Card”.

Using Google Pay, you can link not only a bank card, but also a discount card.

However, it will work a little differently. Discount cards are read by the cashier upon presentation of a barcode that will be displayed on the screen of your smartphone when you select the appropriate card from the list. And payment by a bank card is carried out by applying the device to the terminal.

Samsung Pay

On the smartphones of the South Korean company Samsung, another application is installed by default – Samsung Pay. It works in a similar way to Google Pay and allows you to integrate a bank card:

- Select how to secure transactions with a password, fingerprint, or other method.

- Click the Add Card button.

If everything is done correctly, then the first time you go to the store after setting up, you can make a payment. To do this, simply put the phone to the terminal, after which the transaction will take place, and you will receive a check.

Applications of banks

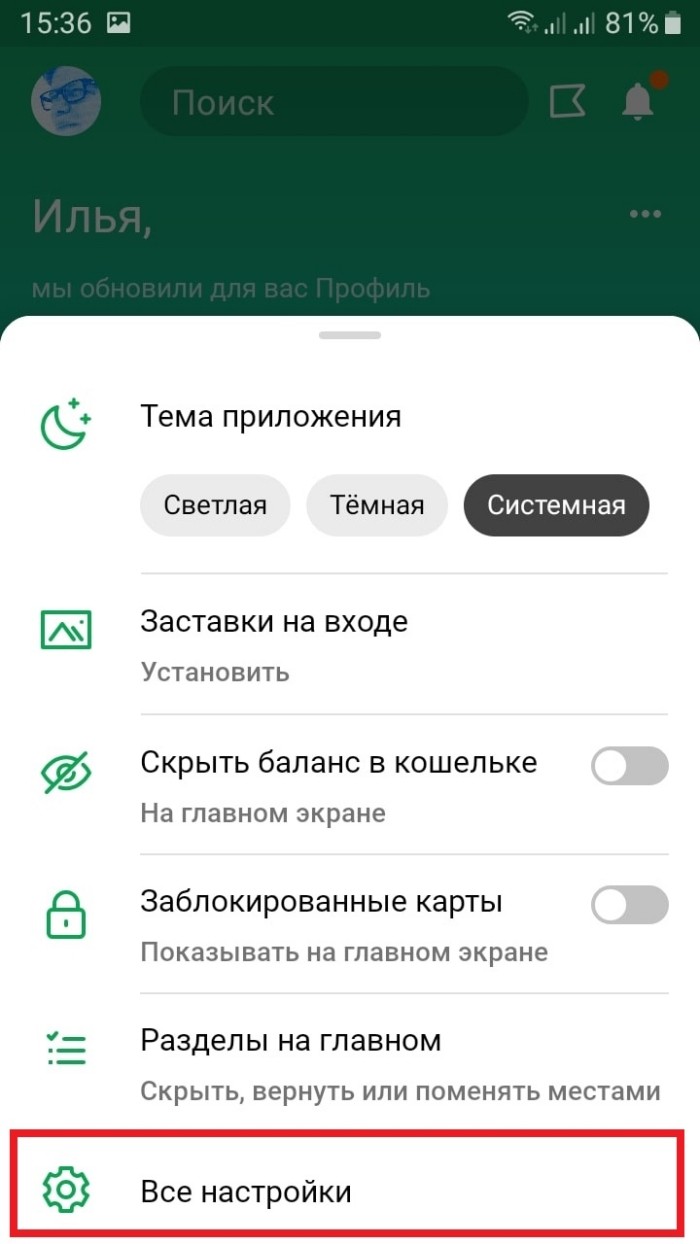

The contactless payment function is supported not only by universal services like Google Pay and Samsung Pay, but also by official bank applications. If you use the services of only one monetary organization, then this method will be the most optimal for you. Using the example of Sberbank Online, let’s see how a card is added:

- Tap on your profile icon.

- Open the setting.

Contactless payment is configured in the same way in the applications of other banks. Also, if you wish, you can pay for purchases without a card if you create a virtual account.

Possible problems

Despite the fact that enabling the option and its further configuration looks like a fairly simple operation, many owners of Android devices experience a lot of problems with contactless payment for purchases. Let’s consider the most frequent of them and offer the best solution methods:

- Cannot find the NFC switch or install the payment app. This problem is related to the lack of NFC support on your smartphone. Use the NFC Checker app to check for a sensor.

- I can’t add my card to Google Pay or Samsung Pay. Check the correctness of the data entered, as well as the expiration date of the card, since it is always limited.

- After setting up the application, I cannot pay for the purchase. On Xiaomi smartphones, this problem is related to the location of the security element. The default may be “SIM Wallet”, but you need to select “HCE Wallet” in the phone settings. It is also recommended to check NFC activation and choose the default application for making payments through the phone.

- Contactless payment via Google Pay and other applications stopped working. Recently, Visa and MasterCard payment systems have left the Russian market. Therefore, it became possible to use contactless payment only if you have a MIR card through the MirPay application.

With a high degree of probability, you will be able to solve any problem related to contactless payment. If this does not work, then contact the support service of your bank and clarify all the necessary information.

Risks of paying by phone

Since when using the NFC function we are talking about making transactions in a contactless way, the issue of security when making transactions is acute. However, you should not worry too much about this. Through Google Pay, payment takes place only on the unlocked screen, and when using Samsung Pay, you need to additionally confirm the transaction. The main thing is not to forget to establish a reliable method of protection before making a direct payment.

When applying for a credit card, a new bank borrower receives a minimum limit, so it may be necessary to increase it. Banks can independently increase the credit limit or at the initiative of the borrower.

What is a credit limit

How the bank sets the credit limit

Reasons for increasing credit card limit

How and by how much the limit increases

Can the bank reduce the limit

Let’s look at ways to increase credit limits in banks and what it will take.

What is a credit limit

A credit card allows the holder to spend the bank’s money within the established credit limit. This is the amount of money within which the cardholder can make transactions on the card. It can be set in the amount of 5 thousand to 1 million rubles. You can use the credit limit many times and free of charge. The borrower can spend part or all of the limit, then replenish the account with this amount and use it again.

The borrower indicates the required amount of the limit when writing an application for a credit card. The Bank has the right to set the declared amount or reduce it at its discretion.

What factors influence the amount of the limit:

- The amount of the borrower’s income. On average, the limit is set in the amount of up to 50-100% of the average monthly receipts to the client’s account.

- Client’s status in the bank. When you first apply for a credit card to the bank, a minimum limit will be set. Payroll clients of the bank, clients using other services of the bank, for example, clients who have issued a mortgage or other long-term loan at the bank, have a large deposit amount, etc., can count on the maximum limits.

- Quality of credit history. Clients with a good credit history can count on the maximum possible limit in accordance with their own income.

- Borrower’s credit burden. Banks check whether the borrower has enough funds to service the new debt, taking into account payments on all existing loans and borrowings.

How the bank sets the credit limit

Banks set credit limits for cards individually.

The procedure for determining the credit limit in the bank:

- The client fills out an application form for a loan at a bank branch or through the Internet bank, indicating the required amount of the credit limit in it.

- The Bank analyzes the application. This takes 3-5 days.

- A decision is made to issue a credit card, it is established under what conditions it can be issued.

- The Borrower is notified of the decision.

- He analyzes whether the credit card conditions suit him, including the credit limit. If so, he signs the paperwork for the credit card.

- After receiving the card, he will be able to use a credit card within the established limit.

Standard credit limits up to 100 thousand rubles. the bank establishes according to the passport and does not ask for certificates of income and employment. For amounts up to 300 thousand rubles. an additional document may be required (driver’s license, SNILS, etc.). If the available amount is more than 200-300 thousand rubles, it is required to document the income, provide a copy of the work book or employment contract.

Reasons for increasing credit card limit

Depending on the bank, the credit card limit may be increased at the initiative of the credit institution and/or the cardholder. For example, in Sberbank the limit will be increased only by the decision of the bank, and in Sovcombank, VTB, the borrower can apply for an increase on his own.

The reason for applying to the bank of the client for an increase in the credit limit may be the fact that the minimum limit was initially set, and it is not enough for the user to meet his needs.

In what cases do banks increase the credit limit:

- The borrower actively uses the credit card, uses the entire credit limit.

- The income of the borrower has increased. For example, large sums of money began to flow into the salary account in the bank.

- The borrower pays the debt a few days before the due date.

- The cardholder opened a deposit or became a payroll client of the bank, which indicates his readiness for long-term cooperation with the bank.

Banks can set additional requirements, for example, in Alfa Bank, the limit increase is allowed no more than once every 3 months, while at least 3 minimum credit card payments must be made.

How and by how much the limit increases

The limit is automatically increased by the bank if the analysis of the borrower has shown that he will be able to service a large amount. The frequency of monitoring the borrower’s solvency is determined by the bank’s credit policy. For example, Sberbank analyzes once a year, Sovcombank – quarterly, i.e. you should not wait for the increase of the limit before the passage of the control period.

How to self-apply for a credit card limit increase:

- Through a personal account on the bank’s website.

- In the mobile application.

- When visiting a bank office.

- SMS Command.

- Call the hotline.

Please note that the bank may request a certificate of the borrower’s income and other documents confirming his solvency.

In this case, the bank makes a decision after considering the application at any time, regardless of the control period.

If the bank makes a positive decision, the borrower will receive a corresponding SMS notification on the phone.

Can the bank reduce the limit

In accordance with the data obtained from the analysis of the borrower, the credit card limit can be not only increased, but also reduced. In what cases is it possible:

- The borrower does not actively use the credit card, does not use the entire limit.

- Less funds began to flow into the salary account.

- An overdue debt has formed on the card.

- The borrower has issued a new loan and its solvency is questionable by the bank.

If the borrower does not use the credit card within 3–6 months, the credit limit is reset to zero. Credit card holders receive an SMS notification about the reduction of the credit limit.

Frequently Asked Questions

In order to reduce the amount of funds available on a credit card, you need to notify the credit institution of your decision. This can be done in the Internet bank, mobile application, by visiting the lender’s branch or by calling the hotline.

Why don’t my credit card limits increase?

This can happen for several reasons:

- The credit card was issued recently, the bank is revising the limits in accordance with its regulations, so it can take from 3-6 months.

- You do not use the fully established limit and the bank considers that it is enough for you.

- You are not a payroll client, and the bank does not see if your income has grown or not.

- The bank’s program does not provide for an increase in limits on existing credit cards.

Withdrawal

You can increase your credit card limit if you comply with the bank’s requirements.

Some credit institutions allow an increase in the credit limit at the request of the borrower, in others it is possible only at the initiative of the bank.

To increase the amount of available funds on a credit card, the following factors are checked:

- Borrower’s solvency.

- Credit card usage activity.

- Quality of credit history.

- Availability of new loans.

If the analysis of the client’s data showed a deterioration in performance, the bank may reduce or cancel the credit limit.

Before applying for a credit card, find out in advance about the conditions for its use, whether it will be possible to increase the credit limit, how this happens in a particular bank, since the credit policy of banks is different.

Samsung Pay is a unique development adapted for contactless payments in terminals with NFC and MST support. You can pay for goods even where there is an old reader that only accepts cards with a magnetic stripe. Keep up with the times, learn how to pay for Samsung Pay and you will greatly simplify your life, save time.

Samsung Pay works exclusively on the devices of its manufacturer. The firmware also plays a role – it must be original. It is also important to have an NFS module in the gadget.

Contactless payment can be connected to a number of smartphones and watches from Samsung, namely:

- Samsung Galaxy A6, A7, A8, A9, A20, A30, A40. A50, A80;

- Samsung Galaxy J6+, J4, J7, J5;

- Samsung Galaxy S10e, S10, S10+, S9, S9+, S8, S8+, S7Edge, S7, S6Edge+, S6, S6Edge

- Samsung Galaxy Note 5, Note 8, Note 9, Note10, Note10+

- Samsung Gear S3 classic,

- Samsung Gear Sport;

- Samsung Galaxy Watch;

- Samsung Galaxy Watch Active, Active2.

When buying, you need to look at the technical characteristics of the device. It is important that the gadget is equipped with an NFS chip.

Launching Samsung Pay for the first time and adding a card

In order for Samsung to pay by phone, you need to prepare the device, link the payment instrument.

If your smartphone supports NFC, please make sure the firmware is updated to the latest version. An outdated one will not allow you to fully configure the service and work with it.

Initially, you need to find Samsung Pay. It is preinstalled and you don’t have to download it.

Keep in mind! The absence of an application in the phone menu may indicate non-original firmware or that the smartphone does not support Samsung Pay.

If Samsung Pay is found, the instructions for setting it up are as follows:

- Launch the application.

- Enter your Samsung Account details.

- Accept the terms of use of the service.

- Click on Launch.

- Select the type of identification (pin code, fingerprint, iris scan).

After you need to add the card itself. Without it, paying by phone will not work.

- In the application, find the inscription “Payment”, then “Add card”.

- Choose the most suitable among the two options (scanning a payment instrument or entering data yourself).

- Accept the terms of the bank.

- Sign (with stylus or finger).

After the card will be added to the system.

Attention! Subsequent means of payment (up to 10 pieces) are tied in a similar way.

Linking the card to the watch

If you have a Samsung Watch, you will need the Galaxy Wearable app to add a card. If you have a Gear watch, then download the Samsung Gear program.

If the application is already installed on the smartphone, then you can start linking the payment instrument. For this:

- Launch Galaxy Wearable or Samsung Gear (depending on watch model).

- Go to the “Payments” section and then open Samsung Pay.

- Press

- On the watch, confirm the action. Study all the training points, follow the instructions. Set up a screen lock.

- Hold the back button. This will launch the Samsung Pay app on the watch.

- On the phone, click on “Add card”.

- Scan it. Another option is to enter data manually.

- Wait for confirmation.

- Check “Accept All”. By doing so, you agree to the terms of service.

- Pass identification. To do this, click on SMS. You will then receive a password on your phone. Enter it and submit.

- Leave a caption on the screen and save.

- Confirm actions on the watch. At the end go to

Pay with your smartphone anywhere

Before learning how to pay for Samsung Pay, it’s good to know where such payments are allowed.

You can pay via contactless service from Samsung at:

- stores, supermarkets, salons;

- public transport (metro, trolleybuses, trams);

- the Internet (on sites that support Samsung Pay payment, for example, on aliexpress);

- applications;

- cinemas, theaters, circuses, etc.

Gas stations and parking are no exception.

Keep in mind! In all of the listed places, it will be possible to pay via Samsung Pay if there is a terminal with PayPass support and support for the Samsung service at the checkout.

Payments via Samsung Pay

You can conduct money transactions using Samsung Pay using the terminal (via NFC or MST) or via the Internet.

Payment in terminals

Consider the instructions for paying using a phone and a watch.

Smartphone payments

To pay via mobile, you need:

- Launch Samsung Pay (swipe up on the screen with your finger).

- Log in (enter a password or put a finger to scan a papillary pattern).

- Select a card (if several payment instruments are loaded into the application).

- Bring the gadget to the terminal and wait for a notification about a successful transaction.

Wearable Payments

To pay for goods from a watch, you should:

- Press the top button on the right.

- Turn the bezel to select a payment card.

- Sign in.

- Approach the reader with the watch.

After a successful withdrawal, the watch will vibrate and a check mark will appear on the screen.

If you took the watch off your wrist, you will have to enter the pin code every time you pay. If they are on the wrist, then authorization will be required only once.

How to pay with Samsung Pay in online stores and apps

Through Samsung Pay, you can safely pay for online purchases. Online shopping attracts many, but sometimes people get burned because they fall for unscrupulous sellers. Highlighting these cards often leads to loss of money. With Samsung Pay, this is impossible, since all information remains hidden.

Don’t know how to pay with Samsung Pay online? Then follow the instructions:

- Visit the site where you want to buy something.

- Add items to your cart.

- At the time of payment, click on “Pay for Samsung Pay”.

- Log in, that is, enter the password and mail from your Samsung account.

- Click on the card you want to withdraw money from.

- Confirm your actions with your fingerprint.

Attention! With Samsung Pay on the Internet, you can work with any browser. There are no restrictions, as in Apple Pay.

Many online stores work with this contactless payment system. But this is not the limit. Samsung promises that in the future the list of partners will actively increase.

Now you can pay via Samsung Pay in apps. The technology is the same as described above.

Can I use Samsung Pay abroad

Samsung Pay partners are numerous banks of the Republic of Belarus (Belarus) and the Russian Federation (Russia). If users of the service go to another country, then it is worth clarifying whether bank cards of a particular financial organization are accepted there and whether Samsung contactless payment is possible there. Such information can be obtained from the employees of the issuing bank.

Is an internet connection required to use Samsung Pay

You can enter the service to pay for purchases without the Internet. It works offline.

Network connection is only required the first time you start Samsung Pay.

How much fee Samsung withholds when making transactions through the Samsung Pay system

There are no commission fees. Users have the opportunity to connect and use contactless payments absolutely free of charge.

Does Samsung store payment information on its server or device

No data is stored anywhere. If you need to remember what purchases were made, then a check will come to the rescue, which you have the right to demand in the store after purchasing the goods.

Conclusion

If you have a Samsung smartphone with NFS support, then it would be useful to know how to pay with Samsung Pay. The service is now becoming quite popular and is one of the safest. Developers are constantly improving their product, entering into agreements with new banks and retail outlets, so it is becoming easier to pay for a purchase. Soon all restrictions will be lifted not only in our own country, but also abroad.

On Samsung smartphones, unlike Apple, there have never been problems with choosing payment services. Google Pay, Samsung Pay, Mir Pay – use the one to which the soul lies. Since March, the choice has been slightly reduced. Google Pay dropped out of the list, and Samsung Pay stopped supporting Visa and MasterCard cards. The possibilities, of course, became smaller, but it was still possible to pay using the phone. At the moment, buyers of new Samsung smartphones are faced with the fact that they are unable to add their Mir cards to Samsung Pay.

I am glad that on Android you can always find an alternative to non-working services.

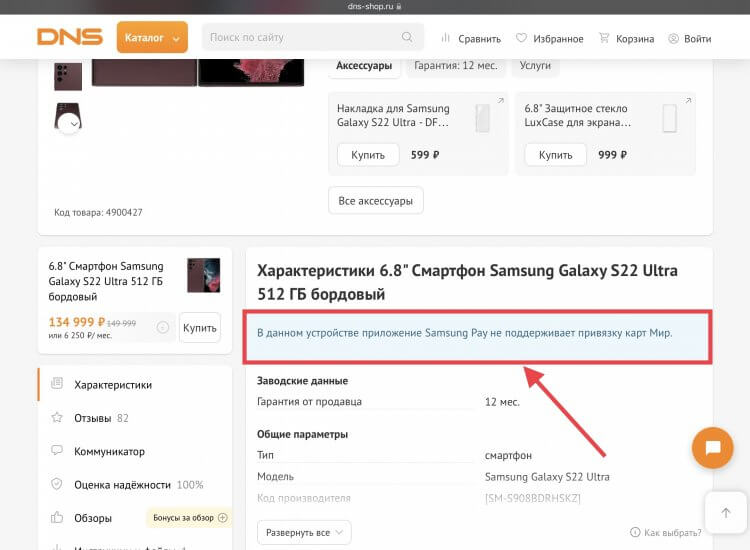

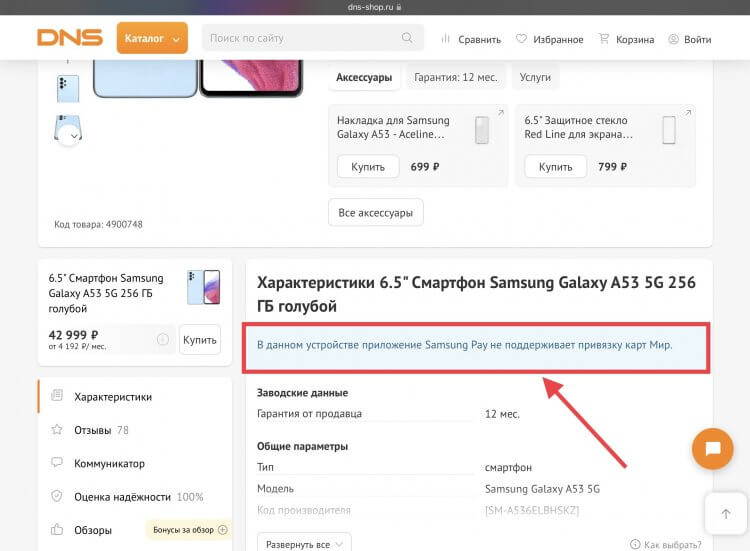

As it turned out, this is a massive problem, and equipment sellers are aware of it. But only one large network notifies about it. Let’s see what is the reason for such restrictions and how now to pay for your purchases to owners of Samsung devices.

Samsung Pay — World card

If the Mir card is not added to Samsung Pay, don’t panic.

The parallel import mechanism has been successfully functioning in our country for several months. It is thanks to him that new smartphones and other electronics appear on store shelves. Not all manufacturers were included in the list of allowed parallel imports. Only companies that continued to supply devices to Russia managed to avoid this.

❗️WE HAVE A SUPER-COOL TELEGRAM CHAT. DEFINITELY JOIN, YOU WON’T REGRET

Samsung does not belong to such companies, and its devices are allowed to be imported into our country using this mechanism. For those who do not yet know the essence of the process, let us briefly recall. A certain company purchases devices intended for another state, excluding all contacts with the manufacturer of these devices. Such gadgets were initially certified for other countries and are not intended for use in Russia.

This is what the ad looks like on the Samsung Galaxy S22 Ultra page.

This is how Samsung smartphones are now on sale. You can still determine this using the information on the page with smartphones in various large online technology stores. It indicates that the seller’s warranty applies to the device. It is the sellers who give a guarantee for equipment imported through parallel imports.

All Samsung smartphones are affected by this problem.

Often, for the sake of high sales, large retailers go not only to various tricks and promotions, but sometimes to deceit. As practice has shown, only one large network informs its customers that Samsung devices imported through parallel import and intended for other countries do not support adding Mir bank cards to Samsung Pay.

That is, users who have bought new Samsung smartphones, when trying to add a World map, simply will not be able to do it. It is not clear whether this is due to sanctions or simply to the lack of support for World maps in the country where the smartphone came from. The fact is important. At the same time, it is not at all clear whether it will be possible to return such a device back to the seller, justifying this by the fact that one of the key functions does not work normally.

Mir Pay to Samsung

Mir Pay is the best alternative to foreign payment services right now.

In this whole situation, only one thing is really annoying. Why only one major store has posted such information on the page of each such smartphone. Why does no one else have the courage to admit this to customers? I have only one answer to this question – an irresistible desire to earn money. And users will figure out what to do. The most interesting thing is that Samsung Pay has a very worthy alternative that you can use without any problems. The difference with Samsung’s proprietary payment service will not be visible.

❗️ SUBSCRIBE TO THE ALIBABA CHEST TELEGRAM CHANNEL TO BUY ONLY THE BEST GOODS FROM ALIEXPRESS

If you have purchased a new Samsung smartphone and the Mir card is not added to Samsung Pay, then most likely this device is not intended for the Russian market. To use your phone as a means of payment, simply install the Mir Pay application on it. Add your bank card and pay without any problems. The principle of operation is the same as that of Samsung Pay. Simply unlock your smartphone with your fingerprint or passcode and tap it on the terminal. The payment will be posted automatically.

Mir Pay has only one limitation. This application works exclusively with Mir payment system cards. Adding a Visa or MasterCard to the program will not work. For those who still do not have a Mir card, I suggest using the YuMoney service. In a nutshell, let me remind you the principle of its work.

- Download the YuMoney application and start a wallet with replenishment using any of your bank cards.

- Create a virtual card for offline payment.

- Choose YuMoney as your default payment service.

After that, it will only be enough to replenish the Yu.Money wallet with the amount you need and pay for purchases in stores using a smartphone. Payment is carried out according to the principle similar to other payment applications. Unlocked, brought, paid.

In general, Samsung smartphone users will not be left without offline payments using their phone. It’s just that retailers need to have the courage to tell consumers about the limitations and alternatives before they buy. Then buyers will be able to accurately make an informed and balanced choice. And for those who have already bought smartphones with limitations in Samsung Pay, choose an alternative payment method and use it. You won’t even feel the difference.

Activate Samsung Pay on your smartphone

- You need to open the Samsung Pay application, log in using your Samsung account details.

- If it has not been created, you need to register a new one.

- There are three ways to confirm a payment: fingerprint, iris scan or PIN code. To choose one of the possible ways, you must follow the prompts.

- Confirm actions.

- Add bank card details and save them.

Samsung Pay application menu

- “Home”: view the added card (payment and club), money transfers.

- “Payment” section: select a card to pay or send a transfer.

- Menu “Services”: all available financial transactions and services.

- icon (≡) opens sections: “Settings, Notifications, Samsung Account ID and more”.

If there is no Samsung Pay application in the Play Store of your smartphone, it may be because:

- smartphone model or version does not support Samsung Pay service (outdated or budget models);

- the smartphone was purchased abroad and is not intended for Russian users;

- The original firmware is not installed on the device.

A list of phones and other devices compatible with Samsung Pay can be found on the official Samsung website under: Which devices work with Samsung Pay.

How to add a card number to Samsung Pay

To connect your card details to the Samsung Pay electronic payment system, do the following:

- in the Samsung Pay app, tap the Plus icon in the upper right corner of the screen;

- allow the application to take photos;

- you can scan the card using your smartphone’s camera or enter data manually;

- accept the terms of servicing the card by the bank;

- press the “SMS” button to authenticate the cardholder;

- an SMS with a one-time password will be sent to the phone number linked to the card;

- enter the received code;

- enter owner’s signature with stylus or finger;

- click the “Save” and “Done” button.

The signature will come in handy if the cashier decides to compare the signature on the card and on the receipt. You can add and use up to 10 payment cards on your device.

How to transfer card numbers to a new device

To restore card data or transfer it to a new device, or to an old one after a factory reset, follow these steps:

- sign in to Samsung Pay using the Samsung account you used on your previous phone or before the factory reset;

- full activation of the card, identification of the cardholder using the SMS code from the bank, follow the instructions from the application on the screen;

- The only way to add a card to Samsung Pay is through the bank’s web app, if it supports it. You need to find the “Add Samsung Pay” button in the card actions section.

To open the Card Information menu, select a card and press the Options button (three dots). In this section you can:

- view transaction history;

- remove the card from the “Payment” menu;

- show the cardholder’s signature;

- change the name of the card or remove the card from Samsung Pay.

Payment via Samsung Pay

For this you need:

- open app: swipe up from any screen;

- choose a card for payment from among the added ones;

- go through authorization in the previously established way: fingerprint scanning, pin code or iris to make a payment;

- bring the smartphone closer to the payment terminal.

Samsung Galaxy smartphones use MST (Magnetic Secure Transmission) technology. This means that the application can transfer data in magnetic stripe format. This means that you can pay with your smartphone and Samsung Pay in all terminals, and not only in those that support contactless NFC technology. To learn about MST support on a specific smartphone, check the Samsung Pay compatible list.

Money transfers to Samsung Pay

You can transfer money from any card that the user has added to Samsung Pay. The recipient of the transfer does not have to be a registered user of the application. You can send a transfer simply by using your mobile phone number. If the recipient of the transfer is using the Samsung Pay app, they will receive a notification from the app when the transfer arrives. To receive money, you need to see a notification, go to the application and select the card on which you want to receive money. In other cases, the recipient will receive an SMS from the transfer operator. It is necessary to follow the link in the SMS notification, confirm the phone number, enter the card details to receive it.

Registration for money transfers

- Log in to the SP app.

- Select the Money Transfer menu.

- Accept the terms of use.

- Enter your name and phone number.

- Receive a confirmation code from an SMS message from a money transfer operator.

- Enter it in the required field.

- An Internet connection is required to send money through the Money Transfer service. The phone must have a SIM card from a Russian mobile operator.

How to send a transfer

- Select a card, click on the “Money transfer” tab.

- Enter the transfer amount and message for the recipient. You can also change the recipient’s name.

- Check the details of the transfer, accept the terms of use of the money transfer operator, confirm the transfer with the selected method: fingerprint, iris or Samsung Pay PIN.

- How to view transfer information.

- In the “History” tab, you can check the status and details of the transfer.

- After receiving the money and confirming it by the recipient, the amount of the transfer will be displayed in the “Done” menu marked “Sent”.

- You can mark the transfer before the Recipient confirms receipt.

- The operator takes a commission for transfers. The bank servicing the card may also set a fee (commission usually does not apply to debit and payroll cards).

How to receive a transfer

- If the transfer is sent to the card number, it is automatically credited.

- If money is sent to a Samsung Pay user’s phone number, the recipient will receive a push notification of the transfer. To confirm, open the notification or find it in the “Money transfers” – “History” section, click the “Receive” button and select the card details you want to receive.

- Other recipients who are not users of the Samsung Pay money transfer service will receive an SMS message from the Money Transfer Operator with a link to confirm and receive money.

- On the confirmation page, you must specify the phone number and card number you want to receive.

If the PIN code is lost

The app PIN cannot be recovered due to security reasons. If the PIN code is lost, do the following:

Delete Samsung Pay app data. The card information will be deleted.

Sign in to Samsung Pay again and follow all the commands from the beginning according to the on-screen instructions: enter a new PIN code or scan your fingerprint, re-enter your card details.

How to delete app data

- Before uninstalling, you need to know the version of Android on your device. To do this, do the following:

- From the Settings menu, select About Device or Phone Information.

- Select “Software Information”. If there is no such item, go to the next step.

- The Android version field shows the installed version. If Android does not turn on, you will not be able to find out the version.

Deleting data on Android of different versions

- Select Applications from the Settings menu.

- Find the app you need to delete data.

- Under “Storage”, select “Delete data”, click “Delete”.

- All app usage history will be deleted after installation. If the Delete Data button is disabled, the data has already been deleted.

Data on Android 8, 7, 6, 5

- From the Settings menu, select Programs or Program Management.

- Scroll from left to right to the All section. If there are no tabs, continue to the next step.

- Find data cleaning apps.

- Select the “Memory” menu. If this element is missing, skip the step.

- Click on “Wipe data”, confirm the action to delete all settings and application data.

NFC Expert

NFC Expert